ISLAMICOIN (ISLAMI) is a cryptocurrency company that offers customer support and headquarters in the United States.

ISLAMICOIN (ISLAMI) phone number.

You can reach the Islamic Finance Association of North America (IFANAM) at (202) 955-8000.

ISLAMICOIN (ISLAMI) support.

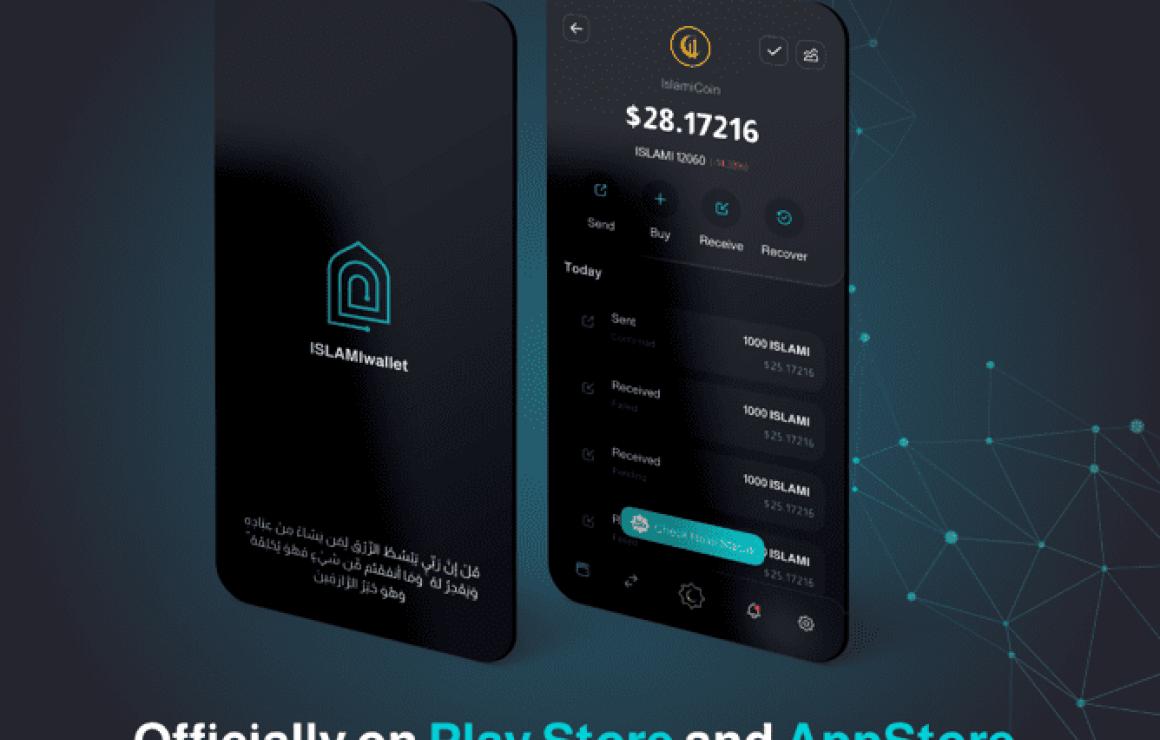

We are happy to announce our support for Islamicoin (ISLAMI).

Islamicoin is a new digital currency based on the Ethereum blockchain. It offers a fast, secure and private way to pay for goods and services online and in person.

We believe that Islamicoin will be a valuable addition to the crypto-currency ecosystem, and we are excited to support it.

ISLAMICOIN (ISLAMI) customer care.

The Islamic Society of North America (ISNA) is the largest Muslim American civil rights and advocacy organization. ISNA provides informational resources and support to its members, engages in public policy advocacy, and collaborates with other Muslim organizations on issues of mutual concern.

To learn more or to reach customer care, please visit:

Islamic Society of North America: https://www.isna.org/customer-care/

Coinbase: https://support.coinbase.com/hc/en-us/articles/115001583-Coinbase-Customer-Care

What is ISLAMICOIN (ISLAMI)?

Islamicoin is a new cryptocurrency and digital asset designed to support the Islamic financial system. It is based on the bitcoin platform and uses the same cryptographic algorithm. The total number of Islamicoins in circulation will be capped at 100 billion.

ISLAMICOIN (ISLAMI) headquarters.

The Islamic blockchain is a distributed database that maintains a continuously growing list of verified transactions. Transactions are grouped into blocks and then chained together using cryptographic proof-of-work. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin mining creates new bitcoins by solving complex mathematical problems. They are created as rewards for a process known as mining. Bitcoin miners are rewarded with transaction fees and newly created bitcoins.

Islamic finance is the financial system based on the principles of Islam. Islamic finance includes traditional banking products and services as well as unique products and services that are not available in conventional banking systems. Islamic finance is growing quickly, with assets under management estimated to be worth $2.5 trillion by 2021.

Islamic banking is a branch of banking that follows the teachings of Islam. Islamic banking is based on the principle of riba or usury, which prohibits lenders from charging interest on loans. Islamic banks are required by Sharia law to adhere to certain principles, including the prohibition of charging interest and the provision of necessary financial services to all members of society, regardless of their religious beliefs. Islamic banking is growing rapidly, with assets under management estimated to be worth $1 trillion by 2021.